The Best Guide To Paul B Insurance Huntington Ny

Table of ContentsSome Ideas on Paul B Insurance Huntington Ny You Need To KnowFascination About Paul B Insurance Huntington Ny10 Simple Techniques For Paul B Insurance Huntington NyIndicators on Paul B Insurance Huntington Ny You Should KnowThe 5-Minute Rule for Paul B Insurance Huntington NyPaul B Insurance Huntington Ny - The Facts

Part An insurance coverage starts: The 3rd month after the month in which a normal program of dialysis begins; or The initial month a regular training course of dialysis starts if the specific participates in self-dialysis training; or The month of kidney transplant; or 2 months before the month of transplant if the individual was hospitalized during those months in preparation for the transplant.People with revenue higher than $85,000 as well as married pairs with earnings greater than $170,000 must pay a greater premium for Part B and also an additional amount for Part D insurance coverage in enhancement to their Part D strategy premium. Much less than 5 percent of individuals with Medicare are affected, so most individuals will not pay a greater premium.

How Paul B Insurance Huntington Ny can Save You Time, Stress, and Money.

The regular monthly costs for Part A may raise as much as 10%. The person will certainly need to pay the higher premium for two times the variety of years the person could have had Part A, however did not sign up. Instance: If an individual were qualified for Part A for 2 years but did not sign-up, the individual will certainly need to pay the higher premium for 4 years.

These strategies are provided by insurance coverage firms, not the government government., you have to also qualify for Medicare Parts An and B. Medicare Benefit strategies additionally have particular solution areas they can give insurance coverage in.

How Paul B Insurance Huntington Ny can Save You Time, Stress, and Money.

You can see any kind of supplier throughout the U.S. that accepts Medicare. You can still get eye treatment for medical problems, but Original Medicare does not cover eye tests for glasses or contacts.

Several Medicare Advantage prepares deal fringe benefits for dental treatment. Many Medicare Advantage intends offer fringe benefits for hearing-related solutions. But you can get a different Part D Medicare medication strategy. It is unusual for a Medicare Benefit strategy to not consist of medication insurance coverage. You can have dual coverage with Original Medicare as well as various other coverage, such as TRICARE, Medigap, professional's benefits, company strategies, Medicaid, and so on.

You can have other double insurance coverage with Medicaid or Unique Requirements Plans (SNPs).

The Basic Principles Of Paul B Insurance Huntington Ny

Brad as well as his other half, Meme, understand the value of excellent service with good benefits. They picked UPMC forever since they wanted the entire bundle. paul b insurance huntington ny. From physicians' visits to oral coverage to our review prize-winning * Health Treatment Attendant team, Brad and also Meme understand they're obtaining the care and solutions they need with every telephone call as well as every check out.

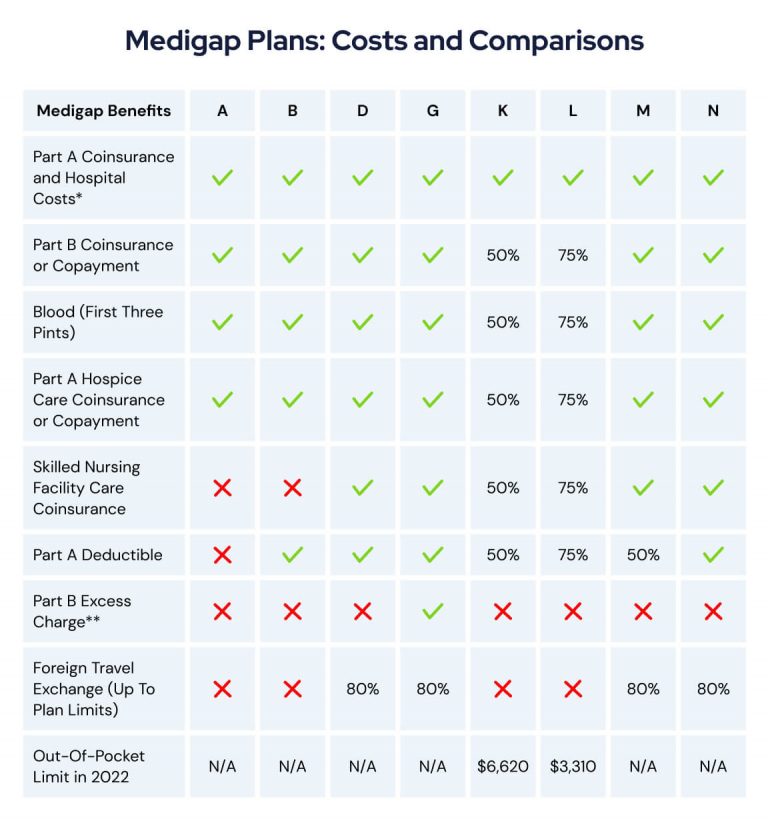

, which covers all copays and also deductibles. If you were eligible for Medicare prior to that time but haven't yet enrolled, you still may be able to get Plan F or Plan C.

The smart Trick of Paul B Insurance Huntington Ny That Nobody is Discussing

If you don't purchase it when you initially become qualified for itand are not covered by a medicine plan with job or a spouseyou will certainly be billed a lifetime fine if you attempt to acquire it later on. A Medicare Advantage Plan is intended to be an all-in-one choice to Original Medicare.

Medicare Benefit Plans do have a yearly restriction on your out-of-pocket prices for clinical services, called the optimum out-of-pocket (MOOP). When you reach look what i found this limitation, you'll pay nothing for covered solutions. Each plan can have a various restriction, as well as the restriction can change yearly, to make sure that's an element to consider when purchasing one.

Out-of-pocket prices can swiftly construct up over the year if you get ill. The Medicare Benefit Plan might use a $0 premium, yet the out-of-pocket surprises might not be worth those first financial savings if you get ill. "The very best candidate for Medicare Benefit is somebody who's healthy and balanced," states Mary Ashkar, elderly attorney for the Facility for Medicare Campaigning For.

Paul B Insurance Huntington Ny Can Be Fun For Anyone

Nonetheless, you may not be able to buy a Medigap plan (if you switch after the previously mentioned 12-month restriction). If you are able to do so, it might cost greater than it would certainly have when you first registered in Medicare. Remember that a company just needs to supply Medigap insurance if you meet specific demands regarding underwriting (if this wants the 12-month duration).

This suggests that when you authorize up later on in life, you will pay more per month than if you had actually begun with the Medigap policy at age 65. You may be able to find a plan that has no age score, however those are rare.

Comments on “Not known Details About Paul B Insurance Huntington Ny”